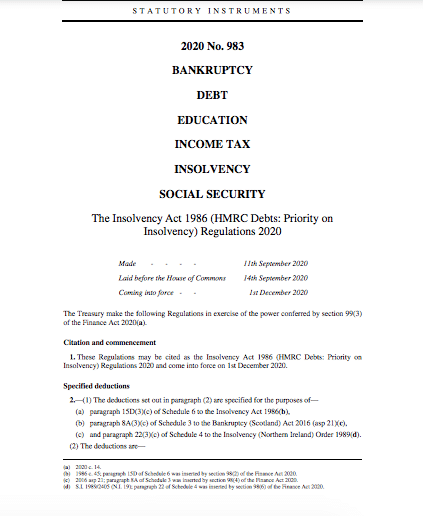

The Insolvency Act 1986 (HMRC Debts: Priority on Insolvency) Regulations 2020 will come into force on 1 December 2020 restoring HMRC as a secondary preferential creditor in insolvencies. HMRC issue the most amount of petitions therefore this legislation will affect the course of action to follow if HMRC are seeking a debt owed to them. If you have been presented with a statutory demand, bankruptcy petition or winding up petition by HMRC, you should seek legal advice immediately.

Under the Finance Act 2020, HMRC has regained its status as a preferential creditor in insolvencies.

What are preferential debts?

Preferential debts are debts which are to be paid in preference to other unsecured debts and also in preference to a holder of a floating charge. Schedule 6 of the Insolvency Act 1986 sets out the categories of preferential debts.

What is the effect of legislation on HMRC’s debts?

HMRC’s debts include debts in respect of income tax, PAYE, employee NICs, construction industry scheme deductions.

In administrations and liquidations, HMRC will be ranked a preferred creditor over floating charge holders and unsecured creditors. Companies will therefore need to repay any outstanding tax liabilities before it can enter into an approved CVA.

If a company is wound up or an individual is declared bankrupt, HMRC will be ranked higher in the list of creditors to be paid out first when assets are distributed, before lenders, company pension schemes or suppliers and customers. The changes are part of the government’s initiatives to crack down on tax avoidance.

Read the legislation here:

How do I challenge a Statutory demand from HMRC?

If HMRC have served a statutory demand on you have the right to apply to court to set aside the statutory demand (pursuant to rule 10.4 of the Insolvency Rules 2016). However usually in 18 days you must act to avoid HMRC applying to bankrupt you if you owe £5,000 or more.

How do I challenge a winding-up petition from HMRC?

A winding up petition from Her Majesty’s Revenue and Customs (HMRC) is just the same as from any other creditor. A large number of winding up petitions are often filed by HMRC as a result of unpaid taxes. HMRC presented 5,302 petitions to wind up companies in 2011-12 compared to 3,367 petitions in 2010-11. When HMRC issues a winding up petition it is normally as a last resort, with no other option but to shut the company down. If the company has secured creditors, it is by no means certain that HMRC (who are unsecured creditors) will recover all (if any) of the monies they are owed.

The debt on a HMRC petition will be for a sum of at least £750, and will usually be in the order of tens to hundreds of thousands of pounds. HMRC will generally give the company notice that the amount is now overdue and should be paid as soon as possible. If the amount is not paid, HMRC will serve a statutory demand and the company will then have 7 days to pay its debts to HMRC.

The monies owed to HMRC could be for the following:

- VAT returns;

- Unpaid VAT assessments;

- PAYE payments;

- Employer’s National Insurance Contributions; and

- Unpaid corporation tax.

What is the HMRC Winding-Up Petition Procedure?

Winding up petitions can be issued by HMRC if they are owed £750 or more by a company and the debt is undisputed. Winding up petitions are likely to be served in the High Court, namely the Chancery Division (Companies Court) based at the Royal Courts of Justice (Rolls Building) in London. Once a winding up petition is issued by HMRC, it is then served on the company usually by a process server visiting the company’s registered office address or sometimes by first class post. A winding up petition will also likely be advertised which may result in the company’s bank accounts becoming frozen. It is important to act quickly and seek legal advice if your company has been presented with a winding up petition.

Instruct Specialist HMRC Petition Lawyers

If you have received a HMRC winding up petition we are able to provide urgent help, advice or representation. We provide expert legal advice from our team of leading HMRC Petition Solicitors or Barristers. Just call or email us now for a free initial consultation; we are waiting to help.

We are a specialist City of London law firm made up of Solicitors & Barristers and based in the Middle Temple Inns of Court adjacent to the Royal Courts of Justice. We are experts in dealing with matters surrounding insolvency in particular issues. Our team have unparalleled experience at serving statutory demands, negotiating with debtors/creditors, setting aside statutory demands and both issuing and defending winding up petitions vigorously at the Royal Courts of Justice (Rolls Building), or the relevant High Court District Registry or County Court with jurisdiction under the Insolvency Rules.

ACT PROMPTLY IN RELATION TO DEBT CLAIMS

Please note that if you have been served a statutory demand or winding-up petition or warned about your file being passed from HMRC’s Debt Management to HMRC’s Enforcement or Solicitor’s Office do not delay in taking legal advice. Your matter can be handled more effectively the sooner you obtain legal advice and representation.

Check Your Insolvency Case ✔

We analyse your winding-up petition prospects. We deliver strategic legal advice at your first meeting. We get optimal legal results. Want a first or second opinion on your case? Click below or call our lawyers in London on ☎ 02071830529

WARNING – OBTAIN SPECIFIC GUIDANCE & ADVICE

The information on this website is not legal advice; you should always obtain specific advice on the circumstances of your case. Our Winding-up Petition Solicitors & Barristers provide specialist legal advice based on decades of expertise. Click here or call +442071830529 to get in touch. For regulatory reasons we do not take on low value cases nor provide free legal advice, information or guidance and our team cannot answer questions from non-clients.